A single integrated gas market for Belgium and Luxembourg

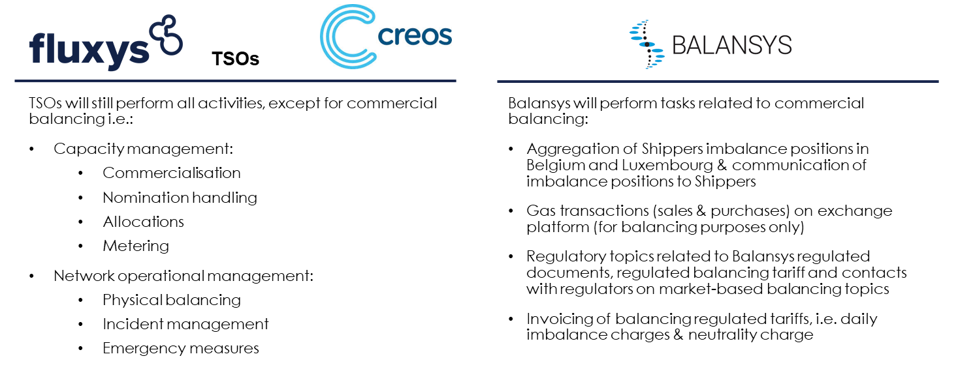

Roles and Responsibilities

On the 1st October 2015, Fluxys Belgium and Creos Luxembourg, merged the Belgian and Luxembourg H-gas markets in one cross-border integrated gas market. The Belgian L-gas market remains a separated market.

The BeLux area is composed of two zones:

- The H-zone is an entry-exit system with a notional trading point “Zeebrugge Trading Point” or “ZTP” and where no capacity must be subscribed to transport gas from Belgium to Luxembourg or inversely.

- The L-zone is an entry-exit system with a notional trading point “ZTP-L”.

The balancing regime within the BeLux area has been harmonized, in this context Fluxys Belgium and Creos Luxembourg created “Balansys” which has been appointed as the Balancing Operator which offers the balancing services in the BeLux area. Fluxys Belgium and Creos Luxembourg remain responsible for all activities except for the commercial balancing.

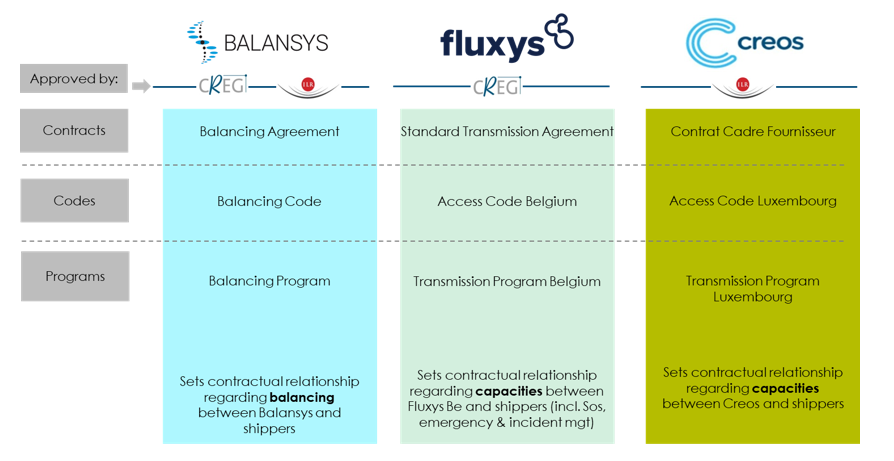

Regulatory framework and contractual set-up

As a shipper in the BeLux area, shipper should:

- sign a Standard Transmission Agreement with Fluxys Belgium in order to become active in Belgium and/or a Contrat Cadre Fournisseur with Creos Luxembourg in order to become active in Luxembourg and comply with the creditworthiness requirements of the Transmissison System Operator(s), and

- sign the Balancing Agreement with Balansys and comply with the creditworthiness requirements of the Balancing Operator.

Hereafter you find an overview of the regulatory framework between the Transmission System Operator(s), the Balancing Operator and the shipper.

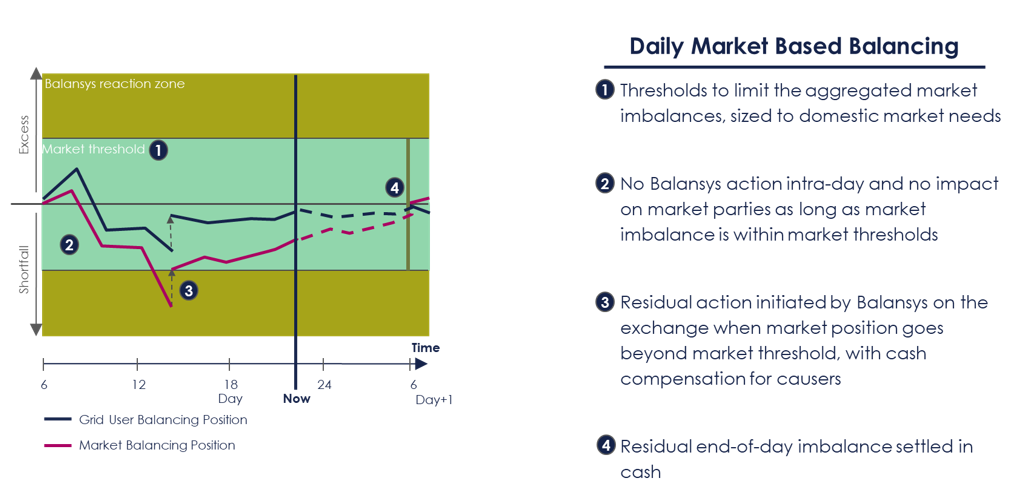

Balancing Model

Shippers are primary responsible for the balancing, this means that Balansys doesn’t take any action as long as the market imbalance is within the market thresholds.

- When during the gas day the market balancing position goes beyond the market threshold, Balansys will take an action to cover this market shortfall or excess and those shippers contributing to this market shortfall or excess (causers) will be financially settled for their share.

- At the end of the gas day, each shipper is settled to zero so that each shipper will start the next gas day with a zero position. This residual end-of-day imbalance is also settled in cash.

Settlement calculation

1) Within day settlements

Shippers who are causing the within day market excess/shortfall (see event number 3 in image hereabove) will be financially settled for their share, in case of:

- Market Shortfall, causing shippers will pay the maximum between the highest purchase transaction price Balansys has paid to cover this settlement and the ZTP Day-Ahead Index* to which the small adjustment for causers is applied

- Market Excess, causing shippers will receive the minimum between the lowest sell transaction price Balansys has received to cover this settlement and the ZTP Day-Ahead Index * to which the small adjustment for causers is applied

Shippers who are not causing the within day market excess or shortfall (helpers) are not being settled for such within day market excess or shortfall.

* The European Gas Spot Index ZTP published by the European Energy Exchange (EEX) serves as the gas price also known as the ZTP DA Index.

Prices used hereafter are just for information purposes only.

Market Shortfall

- ZTP Day-Ahead Index = 23 €/MWh

- Small Adjustment for causers = 3%

- Balancing purchase transactions at 25 €/MWh, 23,5 €/MWh and 22,8 €/MWh

- Highest balancing transaction price = 25€/MWh

- Settlement price = max (25; 23*1,03) = 25€/MWh

Market Excess

- ZTP Day-Ahead index = 23 €/MWh

- Small Adjustment for causers = 3%

- Balancing sell transactions at 23 €/MWh, 22,9 €/MWh and 22,6 €/MWh

- Lowest balancing transaction price = 22,6€/MWh

- Settlement price = min (22,6; 23*0,97) = 22,31€/MWh

2) End-of-day settlements

All shippers will be settled to zero at the end of the day (see event number 4 in image hereabove) and this residual end-of-day imbalance will be settled in cash, in case of:

- Market Shortfall:

- For market shortfall causing shippers, being shippers contributing to the market shortfall, will pay the maximum between the highest purchase transaction price Balansys has paid to cover this settlement and the ZTP Day-Ahead Index * to which the small adjustment for causers is applied

- For shippers who are not causing the market shortfall, being shippers, which have an end-of-day position in the opposite direction, will receive the minimum between the lowest sell transaction price Balansys has received to cover the market settlement (Not applicable as no sell transaction) and the ZTP Day-Ahead Index * to which the small adjustment for helpers is applied

- Market Excess:

- For market excess causing shippers, being shippers contributing to the market excess, will receive the minimum between the lowest sell transaction price Balansys has received to cover this settlement and the ZTP Day-Ahead Index* to which the small adjustment for causers is applied

- For shippers who are not causing the market excess, being shippers, which have an end-of-day position in the opposite direction, will pay the maximum between the highest purchase transaction price Balansys has paid to cover the market settlement (Not applicable as no purchase transaction) and the ZTP Day-Ahead Index * to which the small adjustment for helpers is applied

- * The European Gas Spot Index ZTP published by the European Energy Exchange (EEX) serves as the gas price also known as the ZTP DA Index.

Causer

Market Shortfall

- ZTP Day-Ahead Index = 23 €/MWh

- Small Adjustment for causers = 3%

- Balancing purchase transactions at 25 €/MWh, 23,5 €/MWh and 22,8 €/MWh

- Highest balancing transaction price = 25€/MWh

- Settlement price = max (25; 23*1,03) = 25€/MWh

Market Excess

- ZTP Day-Ahead Index = 23 €/MWh

- Small Adjustment for causers = 3%

- Balancing sell transactions at 23 €/MWh, 22,9 €/MWh and 22,6 €/MWh

- Lowest balancing transaction price = 22,6€/MWh

- Settlement price = min (22,6; 23*0,97) = 22,31€/MWh

Helper

Market Shortfall

- ZTP Day-Ahead Index = 23 €/MWh

- Small Adjustment for helpers = 0%

- Balancing sell transactions: Not applicable as no sell transaction

- Settlement price = max (NA; 23*1) = 23€/MWh

Market Excess

- ZTP Day-Ahead Index = 23 €/MWh

- Small Adjustment for helpers = 0%

- Balancing purchase transactions: Not applicable as no purchase transaction

- Settlement price = min (NA; 23*1) = 23€/MWh

—————————————————————————————————————————————

Questions regarding commercial aspects: info@balansys.dev.lightbulb.lu